Accountant’s Guide to Cloud Storage: Keep Your Data Safe

cloud storage for accountants: 7 Essential, Proven Benefits 2025

Securing Your Financial Data in the Digital Age

Cloud storage for accountants has become essential for modern accounting firms seeking secure, accessible, and compliant data management solutions. Here’s what you need to know:

| Top Cloud Storage Solutions for Accountants | Key Benefits |

|---|---|

| 1. Microsoft OneDrive for Business | 1TB storage per user, Microsoft 365 integration |

| 2. Egnyte | Advanced security, compliance features for regulated industries |

| 3. Box for Business | Secure workflows, e-signatures, audit trails |

| 4. Dropbox Business | Intuitive interface, seamless collaboration tools |

| 5. Google Drive (for Business) | Excellent Google Workspace integration, 15GB free storage |

As an accountant, you handle sensitive financial information daily – from tax returns and financial statements to payroll reports and confidential client data. The stakes couldn’t be higher when it comes to securing this information while maintaining accessibility and compliance.

“If you’re not in the Cloud, you’re not a firm of the future,” noted one accounting firm partner in our research. This sentiment reflects the growing recognition that cloud solutions aren’t just convenient – they’re transformative for accounting practices.

Why cloud storage matters for accounting firms:

- Security: Bank-level encryption protects sensitive client data

- Accessibility: 24/7 access to files from anywhere with internet connection

- Collaboration: Real-time document sharing and editing with clients

- Compliance: Built-in tools for meeting regulatory requirements

- Disaster recovery: Automatic backups prevent catastrophic data loss

- Cost efficiency: Reduced need for on-premise servers and IT infrastructure

I’m Reade Taylor, an ex-IBM Internet Security Systems engineer who has helped numerous accounting firms implement secure cloud storage for accountants that protects sensitive financial data while enabling seamless collaboration. As founder of Cyber Command, LLC, I specialize in bridging the gap between technical security requirements and practical business needs.

Common cloud storage for accountants vocab:

– best secure file sharing for accountants

– cloud based server for accounting firm

– cloud hosting for quickbooks

What Is Cloud Storage for Accountants?

Cloud storage for accountants is like having a super-secure digital filing cabinet that lives on the internet instead of your office. It’s a specialized Software-as-a-Service (SaaS) solution that gives you and your team access to all your important financial documents from anywhere, anytime, using any device with internet access.

One accounting firm that made the leap to cloud storage shared: “Using Onehub has definitely supported our growth. We can secure our very private internal documents, yet control how we and other parties access the documents in real time, which has helped us scale.”

Think of it as your firm’s digital headquarters – a centralized, secure home for all client documents that not only meets those strict regulatory requirements for financial data but also makes your day-to-day work flow much smoother. No more digging through filing cabinets or worrying about leaving an important document at the office!

Core Components of a “cloud storage for accountants” stack

When you invest in a robust cloud storage for accountants solution, you’re getting several powerful tools working together:

Your foundation is the object storage – the actual digital warehouse where your data lives safely in redundant data centers (meaning your data is backed up in multiple locations). On your computer, you’ll have sync clients that automatically keep files updated between your local machine and the cloud – edit a document at home, and it’s instantly updated everywhere.

Need to check something without your laptop? The browser portal lets you securely access everything through any web browser, while mobile apps keep you connected via smartphone or tablet when you’re on the go. Your clients get their own secure space through client portals where they can safely upload tax documents or download finished returns.

Behind the scenes, your admin dashboard gives you control over who can see what, lets you monitor all activity, and helps enforce your security policies – perfect for managing your team and maintaining compliance.

Typical Data Types Housed in “cloud storage for accountants”

As an accounting professional, you handle an incredible variety of sensitive documents. Your cloud storage for accountants solution becomes home to your clients’ most important financial information:

Tax returns for individuals and businesses form the backbone of many accounting practices, alongside detailed payroll reports tracking employee compensation and tax withholdings. Your cloud storage securely houses critical financial statements like balance sheets and income statements that tell the story of your clients’ financial health.

During busy audit seasons, your audit documentation and working papers stay organized and accessible to your team. All your client correspondence remains searchable and secure, while engagement letters defining your professional relationships are safely stored and easily retrievable.

The days of sorting through shoeboxes of receipts are gone when you can digitally organize receipts and invoices in your cloud system. Even important corporate formation documents like articles of incorporation and meeting minutes have their dedicated space in your digital filing system.

Our research shows that accounting firms typically handle enormous volumes of sensitive financial data – making a secure, well-organized cloud storage system not just a nice-to-have but an essential tool for both operational efficiency and staying on the right side of regulations.

Why Accounting Firms Can’t Ignore the Cloud

Let’s face it – the cloud isn’t just another tech buzzword. For modern accounting firms, it’s become as essential as your morning coffee. The transition to cloud storage for accountants represents a fundamental shift in how successful firms operate, collaborate, and grow.

Productivity Gains

Remember those late nights spent shuffling papers and hunting for files? Cloud storage puts an end to that madness. One of our accounting clients shared something that made me smile: “We grew from 3 employees to over 17 and manage over 2,000 clients, without missing a single deadline! It literally runs our firm.”

This isn’t unusual. Many firms report cutting their administrative time in half almost overnight after moving from Excel-based workflows to cloud platforms. Imagine what your team could accomplish with all those reclaimed hours – perhaps actually taking a lunch break for once?

Cost Efficiency

If you’re still writing big checks for server hardware and maintenance, you’re leaving money on the table. Cloud storage for accountants transforms those unpredictable capital expenses into manageable monthly subscriptions.

The savings add up quickly: no more server hardware investments, drastically reduced IT maintenance costs, freed-up office space (hello, new break room!), lower energy bills, and far less software licensing headaches. Your accountant’s brain probably started calculating the ROI halfway through that sentence.

Disaster Recovery

Let’s talk about what keeps firm owners up at night – data loss. Whether it’s a ransomware attack, a spilled coffee on a laptop, or (heaven forbid) a fire in the office, cloud storage for accountants ensures your firm can bounce back quickly.

With automatic backups distributed across multiple secure locations, your client data remains safe and accessible even when disaster strikes. No more anxiety about hardware failures or accidental deletions. Your firm stays operational even in worst-case scenarios – which is especially comforting during tax season.

Real-Time Collaboration

The days of emailing documents back and forth (version_final_FINAL_v2.xlsx, anyone?) are thankfully behind us. Modern accounting requires seamless teamwork, and cloud storage for accountants makes this possible with simultaneous document editing, clear version histories that prevent costly overwrites, threaded comments for contextual feedback, and structured approval workflows.

Your team can collaborate effectively whether they’re sitting next to each other or working from different time zones – which brings us to our next point.

Remote Talent Acquisition

The ability to hire the best talent regardless of zip code has become a genuine competitive advantage. With secure cloud access, your firm can tap into skilled professionals anywhere. That tax specialist in Denver or the QuickBooks guru in Miami can join your team without relocating. The cloud dissolves geographic boundaries, expanding your talent pool dramatically.

How “cloud storage for accountants” turbo-charges client service

Think about how your clients prefer to work today. They expect instant access, professional experiences, and minimal back-and-forth. Cloud storage for accountants delivers on all fronts.

With instant document sharing, you’ll never hear “Did you get my email?” again. Secure links provide immediate access to important documents without the security risks of email attachments.

Your branded client portal creates a professional, consistent experience that reinforces your firm’s identity. As one of our vendors puts it, “Make it your own with your logo and colors for a professional appearance.” It’s your firm’s digital front door – make it impressive!

Perhaps best of all, automated reminders handle the tedious follow-up tasks that consume so much time. The system automatically nudges clients when documents need attention or signatures, freeing your staff from playing email tag.

Clients also love self-service access to their documents 24/7. No more emergency calls for last year’s tax return at 11 PM – clients can simply log in and find what they need, even outside business hours.

Compliance & Risk Reduction Benefits of “cloud storage for accountants”

For accounting professionals, compliance isn’t negotiable – it’s the foundation of trust. Cloud storage for accountants offers robust protection that traditional systems simply can’t match.

Audit trails provide comprehensive logs of who accessed which documents and when, creating ironclad evidence for regulatory inquiries. If you’ve ever faced an audit, you know how valuable this visibility can be.

Immutable backups prevent anyone – even administrators – from altering or deleting files during their retention period. This feature is particularly crucial for meeting legal and regulatory requirements in the financial sector.

Multi-factor authentication dramatically reduces unauthorized access risks, even if passwords are compromised. This simple but powerful security measure has become standard practice for protecting sensitive financial data.

There’s even a financial upside to these security features: many cyber insurance providers offer reduced premiums for firms using enterprise-grade cloud storage with strong security controls. Better protection and lower insurance costs? That’s a win-win.

At Cyber Command, we’ve helped dozens of accounting firms make this transition smoothly. The verdict is unanimous: once they’ve experienced the security, efficiency, and client service benefits of proper cloud storage, they never look back. The only regret we hear? “We wish we’d done this years ago.”

Features and Compliance Checklist

When shopping for cloud storage for accountants, some features simply aren’t optional—they’re essential for keeping your client data secure and your firm compliant. Think of this checklist as your shopping guide when evaluating potential solutions:

| Must-Have Features | Optional but Valuable |

|---|---|

| AES-256 Encryption | AI-powered document categorization |

| Role-based permissions | Optical character recognition (OCR) |

| Multi-factor authentication | Workflow automation tools |

| Version control | Electronic signature integration |

| Audit logs | Custom branding options |

| Retention policy enforcement | Mobile document scanning |

| Secure client portal | Template management |

| Compliance certifications | Advanced search capabilities |

| Backup and disaster recovery | Offline access |

Security Essentials Every Accountant Should Demand

You wouldn’t keep your clients’ financial documents in an open uped filing cabinet, so why settle for weak digital security? Zero-knowledge encryption should be at the top of your must-have list. This means you alone hold the encryption keys, and even the storage provider can’t peek at your sensitive data—it’s like having a safety deposit box where only you have the key.

Multi-factor authentication (MFA) is another non-negotiable feature. Passwords can be compromised (we’ve all been there), but MFA adds that crucial second verification step, typically through your phone. It’s like having both a key and an alarm code for your office—much harder for the bad guys to crack.

Ever had that sinking feeling when a file gets corrupted or deleted? Now imagine that feeling multiplied by a ransomware attack. Look for providers offering ransomware rollback capabilities that can restore your files to a point before the attack happened. It’s like having a time machine for your data!

“Bank-level encryption in transit and at rest safeguards data,” is the bare minimum you should expect. Also, ask potential providers about their penetration testing schedule—good providers regularly test their own defenses before hackers do.

Compliance Playbook for Regulated Data

As an accountant, you’re navigating a sea of regulations. Your cloud storage solution should help, not hinder, this journey.

Retention policies should be automatic and smart—keeping tax returns for seven years, but maybe permanently storing corporate formation documents. The system should handle this without you having to remember every retention rule.

When legal issues arise, you need legal hold capabilities that preserve relevant documents and suspend normal deletion schedules. Think of it as a “freeze” button for your document lifecycle.

Where your data physically lives matters for compliance. Jurisdiction controls let you specify which country or region houses your data, helping you comply with data sovereignty laws like GDPR for European clients.

E-Findy tools are your best friend when regulators or legal teams come knocking. They help you quickly search, locate, and export specific documents without a panicked scramble through thousands of files.

One vendor puts it well: “Data governance solutions can automatically classify documents based on industry-specific rules (GDPR, SOX),” making compliance less of a manual headache.

Integration Must-Haves

Your cloud storage shouldn’t be an island—it needs to play nicely with your existing tools to truly shine.

QuickBooks sync capabilities save hours of manual filing by automatically storing invoices, receipts, and reports from QuickBooks in your cloud system. This alone can eliminate hours of administrative busywork each month. More info about Cloud Hosting for QuickBooks

Getting client signatures shouldn’t involve printing, signing, scanning, and emailing. Look for e-signature API integration that lets clients securely sign documents directly within your system.

Workflow automation transforms how your team handles documents. Imagine tax returns automatically routed through preparation, review, partner approval, and final filing—all with notifications at each step.

Email integration is another time-saver that lets you file email attachments directly to your cloud storage without the download-upload dance.

As one accounting firm told us, “Integration with QuickBooks to automatically file invoices and receipts” dramatically reduced their administrative workload, freeing up time for billable client work instead of document management.

When these features work together, your cloud storage for accountants becomes more than just storage—it becomes the digital backbone of your practice.

Evaluating Providers: A Step-By-Step Framework

Finding the right cloud storage for accountants shouldn’t feel like searching for a needle in a digital haystack. Let’s break down this process into manageable steps that will help you make a confident decision without the headache.

1. Needs Assessment

Before diving into vendor websites, take a moment to get crystal clear about what you actually need. I’ve seen too many accounting firms invest in fancy features they’ll never use while missing crucial functionality.

Start by gathering your team to answer some basic questions: What types of documents do you handle daily? How many people need access? What security requirements are non-negotiable for your clients’ financial data? Which existing software must integrate with your cloud solution? And of course, what can your budget realistically accommodate?

One accounting firm I worked with finded during this process that their team spent hours each week manually sorting client tax documents—a problem they hadn’t even considered when shopping for solutions.

2. Pilot Test

Never commit to a cloud storage for accountants solution without taking it for a test drive first. Most reputable providers offer free trials—use them!

Upload some non-sensitive sample documents and invite a few team members to access them across different devices. Is the interface intuitive? How’s the speed when uploading large files? Do the security controls work as advertised? Can clients easily steer the portal without calling you for help?

These real-world tests often reveal issues that slick sales presentations conveniently gloss over. As one of my clients put it: “The demo looked amazing, but when we actually tried using it, the mobile app was practically unusable for our team.”

3. SLA Review

The Service Level Agreement might seem like boring fine print, but it’s actually your protection plan. Pay special attention to:

The guaranteed uptime percentage (aim for at least 99.9%), specific data recovery capabilities if disaster strikes, response times for support issues (minutes, hours, or days?), clear language about who owns your data, and straightforward policies for retrieving your files if you ever need to switch providers.

Don’t just take their word for it—ask tough questions about how they’ve handled outages or security incidents in the past.

4. Cost Modeling

The sticker price rarely tells the whole story. Create a comprehensive cost model that accounts for the base subscription, additional per-user fees, storage tier pricing that might increase as your firm grows, costs for premium features, and potential price increases over time.

I recently worked with an accounting practice that was shocked to find their “affordable” solution would actually cost nearly double once they added all their staff and the necessary security features. A little homework upfront prevents budget surprises later.

5. Migration Plan

Even the perfect cloud storage for accountants solution can fail if the migration goes poorly. Create a detailed roadmap that documents your current file organization, maps it to the new structure, prioritizes which files to move first, establishes a realistic timeline, and clearly assigns who’s responsible for each step.

For more expert guidance on selecting secure file sharing solutions, check out the latest research on secure file sharing for practitioners.

Building a Shortlist Without Vendor Overload

With dozens of options available, it’s easy to get overwhelmed. Here’s how to cut through the noise:

Create a simple feature matrix spreadsheet with your must-haves in one column and nice-to-haves in another. Then score each provider against these criteria. This visual comparison helps clear away the marketing fog.

Request hands-on demonstrations where you control the mouse, not just watching a polished presentation. Ask to test specific scenarios your firm regularly encounters.

Perhaps most valuable is speaking with fellow accountants who use these systems daily. Their candid feedback about implementation challenges, support quality, and unexpected quirks can save you countless headaches. As one firm told me after their selection process: “We tested about five other solutions like Team Drive, OwnCloud or LeitzCloud. In the end, FileCloud won that battle clearly.”

Budgeting & ROI

Understanding the true cost of cloud storage for accountants goes beyond the monthly bill. Most solutions charge between $5-$25 per user monthly, but that’s just the beginning.

Watch for tiered storage pricing that could balloon as your client files accumulate. Some providers advertise unlimited storage but throttle speeds after certain thresholds. Be vigilant about hidden fees for features you’ll actually need, like advanced security controls, API access, or e-signature integration.

The real financial story includes the opportunity cost of sticking with inefficient systems. One accounting practice I worked with calculated they saved over 2 hours per team member on every compliance job after implementing cloud storage—time they redirected to billable client work instead.

Migration & Change Management

The technology transition is only half the battle—the human transition matters just as much. Create a clear mapping between your current file structure and how it will look in the cloud. This familiar organization helps reduce team anxiety about the change.

Consider a phased rollout starting with your most tech-savvy team members or a small subset of understanding clients. Their feedback helps identify and resolve issues before exposing your entire client base to the new system.

Invest in proper training with materials custom to different learning styles. Short video tutorials, written guides, and live demonstration sessions ensure everyone feels confident using the new tools securely.

For hands-on assistance with this critical transition, our team at Managed IT Support Services for Accounting Firms specializes in smooth migrations that minimize disruption to your practice.

Integrating Cloud Storage Into Your Accounting Workflow

Let’s face it – even the best cloud storage solution won’t help much if it sits isolated from your daily accounting work. The magic happens when you weave cloud storage for accountants into the fabric of your everyday processes. Here’s how to make that happen in a way that feels natural and saves you time:

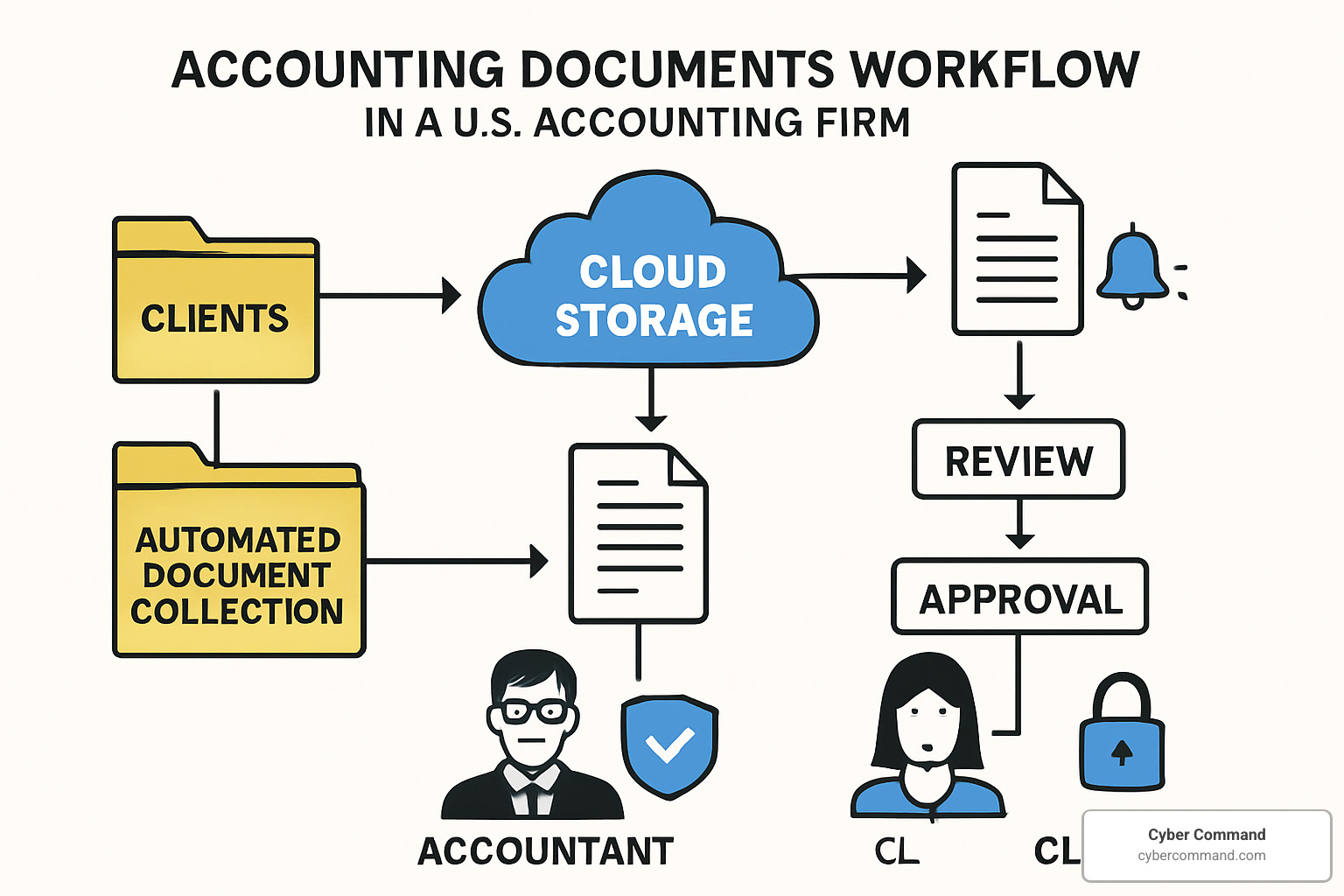

Automated Intake

Remember the days of chasing clients for documents and manually sorting them into folders? Those can be behind you now. With modern cloud solutions, you can create a smooth, automated client onboarding experience.

Set up template folders that automatically generate when you add a new client. Send them secure upload links for tax documents, financial statements, or whatever you need. The system can even nudge them with friendly reminders if something’s missing. And when those documents arrive? You’ll get an instant notification, no email-checking required.

“The automated intake process cut our onboarding time in half,” one accounting firm owner told us. “Clients love how easy it is, and we love not playing email tag for weeks.”

Month-End Close

Month-end closing becomes much less stressful when your team can collaborate in real-time. Store your closing checklists and procedures in shared workspaces where everyone can access them. Work together on financial statements simultaneously – no more waiting for someone to finish and email you the latest version.

When everything’s finalized, your cloud system can automatically archive the reports in the appropriate client folders, complete with a detailed audit trail showing every review and approval step. It’s like having a digital paper trail, but without the paper.

Audit Preparation

Audits don’t have to trigger panic attacks. With cloud storage for accountants, you can maintain a dedicated folder structure specifically designed for audit readiness. Every document version is tracked, so you know exactly what changed, when, and by whom.

Set up retention policies that align perfectly with audit requirements, ensuring nothing important gets deleted too soon. When auditors need access, you can provide them with controlled, temporary permissions to specific documents – no need to email sensitive files or grant broader access than necessary.

Remote Collaboration

Whether your team is spread across different offices or working from home, cloud storage for accountants keeps everyone connected to the same information.

Use comment threads to discuss specific points without losing context in long email chains. Set up approval workflows so documents move smoothly from preparation to review to final sign-off. Share secure links instead of attachments, ensuring everyone’s always looking at the current version. And with customizable notification rules, team members only get alerts about the documents that matter to them.

Seamless Collaboration Between Teams and Clients

The days of playing email ping-pong with clients are over. Cloud storage for accountants creates a shared digital space where collaboration happens naturally.

Create dedicated folders where both your team and clients can access relevant documents. Enable comment threads so questions and answers stay attached to the specific documents they relate to – no more hunting through email chains to find that important clarification from last week.

“Our clients love being able to drop documents into their secure folder and know we’ll see them right away,” shared one accounting practice manager. “It feels more like we’re working together rather than just exchanging files.”

Version tracking means you’ll always know who made what changes and when, eliminating confusion and providing accountability. And with smart notification rules, the right people get alerted when documents need attention.

Want to take your client collaboration to the next level? Check out our guide on Best Secure File Sharing for Accountants.

Remote Work & Business Continuity

If the pandemic taught us anything, it’s that flexibility is essential. Modern cloud storage for accountants makes working from anywhere not just possible but pleasant.

Say goodbye to clunky VPN connections – access your documents securely without extra steps or technical headaches. Work happens automatically backed up, whether it’s done on an office desktop, home laptop, or tablet at your kid’s soccer game.

Need to work during a flight or in an area with spotty internet? Offline sync capabilities let you keep working, with all your changes automatically uploading when you reconnect. And with today’s powerful mobile apps, you can even use your smartphone camera to capture receipts and invoices, sending them straight to the cloud without ever touching a scanner.

Frequently Asked Questions about Secure Cloud Storage

How long should firms retain documents in the cloud?

Let’s face it – document retention isn’t the most exciting topic, but it’s one that keeps many accountants up at night. The good news? Cloud storage for accountants makes compliance much easier.

Retention periods vary depending on what you’re storing and where your practice is located. As a general guideline:

- Tax returns and supporting documentation: Keep these for 7 years after filing – that’s the IRS lookback period for most audits.

- Financial statements: Hold onto these for 7-10 years, depending on your state’s requirements.

- Payroll records: Most regulations require 4-7 years of retention.

- Client correspondence: 7 years is the standard recommendation.

- Workpapers: Again, 7 years keeps you covered in most situations.

The beauty of modern cloud storage for accountants is that you can set automated retention policies. This means your system can automatically flag documents for review or deletion when their retention period expires – no more manual tracking required!

Does cloud storage replace on-site servers entirely?

This is probably the question I hear most often from accounting firms considering the move to cloud storage.

The short answer? It depends on your comfort level and specific needs.

Many of our clients at Cyber Command start with a hybrid approach. Think of it as dipping your toe in the water before diving in completely. This might mean:

Keeping a local backup of your most critical files (belt and suspenders approach)

Maintaining on-site servers for any legacy applications that aren’t cloud-friendly

Using synchronized folders that exist both locally and in the cloud for easy access

I often tell firms that there’s no rush to go “all cloud” overnight. We typically recommend a phased approach, moving different types of data to the cloud as your team becomes comfortable with the new systems.

One of our accounting clients started by just moving their client communication to the cloud, then gradually transitioned their working files over six months. By tax season, they were fully cloud-based and never looked back!

What happens if internet access goes down during tax season?

Ah, the nightmare scenario that makes accountants break out in a cold sweat! When you’re racing against April 15th deadlines, internet outages are the last thing you need.

Here’s how smart firms prepare for this possibility:

Implement offline sync capabilities. Most quality cloud storage for accountants solutions include offline access features. This means you can keep working on local copies of files that will automatically update once your connection returns.

Create connectivity redundancy. Consider having backup internet options – perhaps a business-class cable connection backed up by a 5G hotspot. Different providers often use different infrastructure, so they’re unlikely to fail simultaneously.

Develop clear emergency procedures. Make sure everyone knows what to do during an outage. Which processes can continue offline? Which clients should be notified?

Schedule critical uploads strategically. During tax season, consider uploading completed returns during off-hours rather than waiting until the last minute.

As one of our accounting clients wisely put it after switching to our cloud solution: “We finally sleep better at night knowing we have a plan B, C, and D for when technology inevitably hiccups.”

Conclusion

The shift to cloud storage for accountants isn’t just about upgrading your technology—it’s about changing how your entire firm operates. Think of it as trading in your trusty filing cabinets and server rooms for something that works harder, smarter, and keeps your clients happier.

Risk Mitigation: Let’s face it—keeping client financial data secure keeps most accountants up at night. With features like AES-256 encryption (the same protection used by banks), multi-factor authentication, and detailed audit trails, cloud storage significantly reduces your exposure to data breaches. One accounting partner told us, “I actually sleep better knowing our client data is more secure in the cloud than it ever was on our office server.”

Scalability: Remember the days of emergency server upgrades during tax season? Cloud storage grows right alongside your firm. Whether you’re adding three new staff members or 30 new clients, your storage capacity adjusts seamlessly without those painful hardware upgrades or IT emergencies.

Future-Proofing: The accounting profession is evolving rapidly. Cloud storage positions your firm to easily adopt emerging technologies like AI-powered document analysis that can automatically categorize receipts, or workflow tools that automate routine tasks. Your firm stays competitive without constant technology overhauls.

At Cyber Command, we’ve guided dozens of accounting firms through this cloud transition. Our Orlando-based team understands that accountants have unique needs—especially during tax season when downtime simply isn’t an option. That’s why we’ve custom our support specifically to accounting professionals:

- Real humans answering your calls 24/7/365 (yes, even at 11 PM during tax season)

- Predictable monthly IT costs with zero surprise bills

- Technology planning that aligns with your firm’s growth goals

- Smooth implementation that won’t disrupt your busy schedule

Don’t let outdated technology hold your accounting practice back. Your competitors are already making this shift—shouldn’t you be leading the way instead of catching up later?

For more information about implementing secure, compliant cloud storage for accountants at your firm, check out our resource on cloud server for accountants or give us a call. We promise to explain everything in plain English, not tech jargon.